Education • 11 min read

By Bitpanda

26.09.2025

Crypto-assets, as a new asset class, have generated a lot of interest, some of which has been negative. One of the commonly raised allegations is the topic of speculation and volatility (S&V), which is claimed to harm investors, especially retail ones. In mainstream discourse, crypto-assets are seemingly labelled as a high-risk asset that should not be invested in or one that is strongly discouraged. However, this public discourse often overlooks opportunities that crypto-assets can present. So what is the truth here? Is the criticism about the speculative and volatile nature objectively warranted? Are these only present in the crypto market? And are we really looking at the full picture? In our Bitpanda Blog series Mythbusters, we cut through the noise to present the facts fairly so you can decide for yourself. Let’s take a closer look!

When it comes to money, emotion can often override judgement, making us more prone to pessimism. While concepts like speculation and volatility imply uncertainty and danger, there’s more to it than that. Let’s look at these fundamental concepts in more detail. Investopedia defines speculation as:

Volatility is described as:

The key common denominators here are the price fluctuation changes, and their extent and speed, as well as the mindset of engaging in activities that can produce potential above-average gains while equally acknowledging increased potential losses. Another key element is that both are associated with increased levels of risk. This is true, but it also depends on the context. It’s important to remember that speculation and volatility form part of many human activities, including financial markets, business ventures, and everyday life decisions. This means that they are not exclusive to the crypto market. Speculation and volatility are, in fact, inherent in investing regardless of the market or asset class. It is also important to consider what they are based on, such as the nature of the asset, new trends, economic situations, human psychology, etc.

What frequently falls outside the public debate, however, is the very important aspect of “creating opportunities". This is overlooked since the experience of pain and loss is more acute than the reward. These opportunities in the form of potential (and substantial) appreciation in value, which, if combined with risk mitigation measures, can offset initial risk and losses. This is basically the same as a business entering a new and uncertain market or offering a new product: if they succeed, it has the first mover advantage and others will follow, and if not, then they will suffer losses and lessons will have to be learned - this is why application of risk management is so important.

Typically, the claims about speculation and volatility of crypto-assets are one-sided. Not only do they portray the crypto market as risky, but they also often overlook, as mentioned, the concept of opportunity creation. Here are some opportunities and disadvantages:

Pros:

Cons:

Although the cons can sound frightening, once again, it’s important to remember that there is always a risk even in a more established financial market (stocks, commodities). What is important for the investors is the utmost necessity of risk tolerance management, which should apply to any part of life. One way of approaching this could be to view some of these disadvantages as a ‘cost of entry’ with short-term pain points that need to be tolerated before receiving the overall benefits - the same concept that applies to many aspects of our lives, e.g. short-term pain in the gym for long-term health benefits.

The Harvard University case is a good example of a misjudged and unrealised opportunity due to the negative perception of the crypto market based on volatility, speculation and uncertainty. In 2018, Harvard University professor and economist and former chief economist of the International Monetary Fund, Kenneth Rogoff, opined that:

Interestingly, now it is reported that Harvard University invested around $117m into the Bitcoin ETF, exceeding its stakes in Google and Nvidia.

The short and simple answer is “no”. The only difference between the crypto assets and traditional instruments like stocks or commodities is the level of price fluctuations and susceptibility to market events that can impact the value. It is not surprising that the stock or commodity market is more mature and has a much longer history. This translates into - by and large - a smaller scope of volatility or speculation. This is not to say that traditional markets do not have higher speculative or volatile effects.

Consider, for instance, the investment by Venture Capital (VC) in new emerging businesses and markets, which is inherently risky due to the (usually novel) nature of the venture. There are no guaranteed returns, but a speculation in tech that can go either way. In terms of figures, between 70-90% of start-ups do not produce returns or fail. In addition, VC investments are highly illiquid while capital is often locked in for around 5 –10+ years - yet we still encourage investments in new businesses. Other assets that are speculative and volatile are penny stocks, IPOs, forex trading (speculating and arbitrating on fiat currencies), some equity indices, and certain high-tech stocks.

Let’s look at another example: playing the lottery and gambling are prevalent in modern society; they are definitely speculative, volatile and addictive. Yet these activities are not scrutinised or discouraged to the same level as the investments in crypto-assets. At least when investing in crypto markets, you invest in technology, potentially new development (but not always), while with the lottery and gambling, there is no underlying value, and it is ultimately pure speculation.

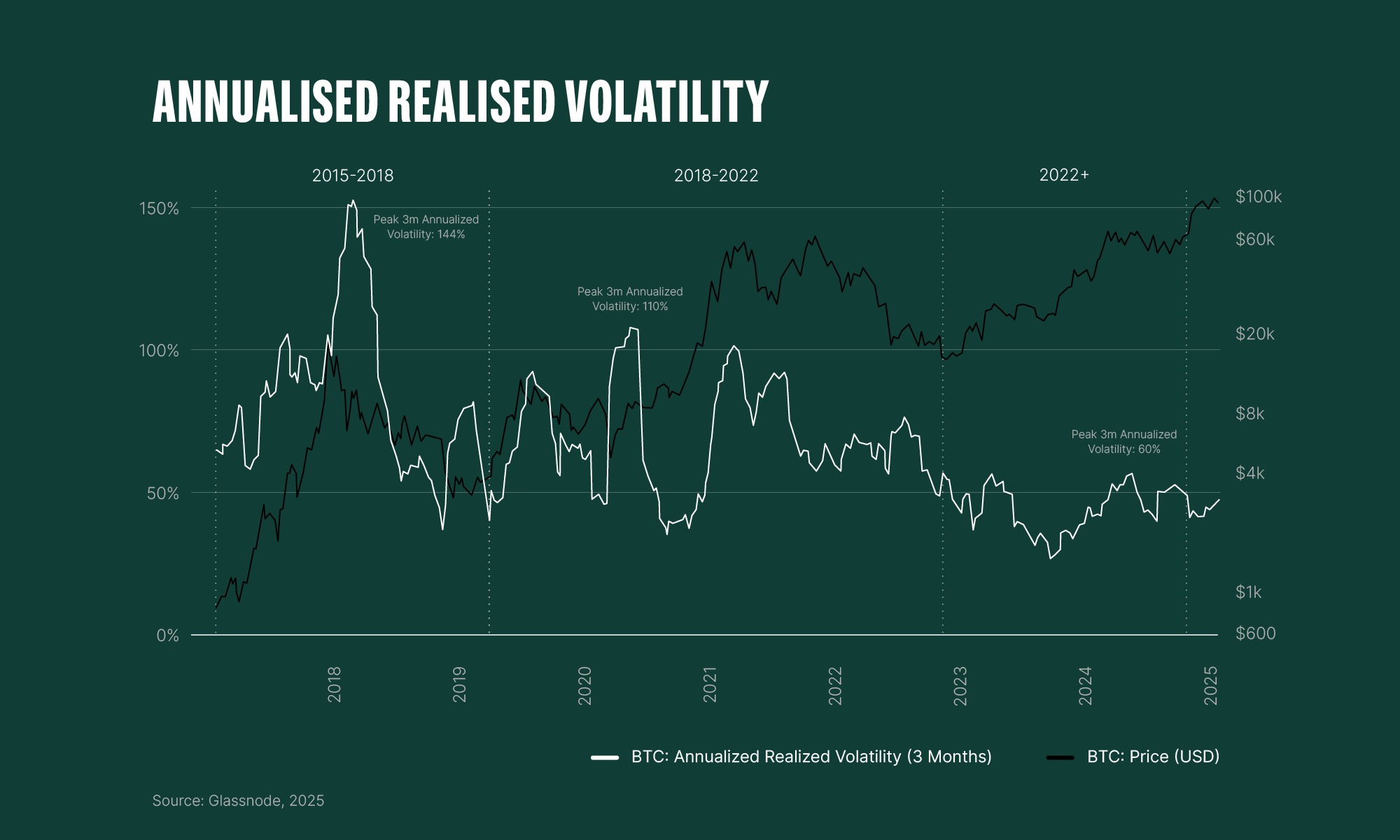

The crypto market has become more stable over the past decade, but most assets still carry high uncertainty and risk. Much of the fluctuation stems from the fact that the industry is still burgeoning, with ongoing regulatory acceptance and developments, prevalent scepticism around new technologies, and abuse by bad actors. However, the volatility and speculation will likely continue to diminish over time as it becomes more mature; the capital flow or outflows will have less impact, being more stable and predictable, and liquidity will improve. This is already visible in the increased institutional adoption and is no different from other, more traditional assets and markets. It should be noted that even the most established assets and commodities, like gold, will fluctuate to some degree. Finally, methods measuring different volatility and speculation can also vary depending on representation (e.g., implied vs realised volatility). Therefore, we should also pay attention to methodologies, similarly to what we presented in the Bitcoin energy mythbuster.

In the crypto market, we can identify assets that, even though still volatile, have a different technological basis and fundamentals that reduce fluctuation risk. Such assets have a strong chance of eliminating or, at the very least, limiting larger price swings in the long run. A good example is Bitcoin versus other projects (like altcoins or memecoins). Bitcoin, as a new asset class, is unprecedented in the history of the world, as its attributes enable it to become a scarce digital store of value. Bitcoin’s response to price swings (due to different market occurrences) has significantly changed over the years. An interesting fact here is that there have been more instances of the Bitcoin price quickly rising rather than swiftly dropping over time. In other words, although drops have been sizable, Bitcoin has been appreciating much more. Let’s have a look at some metrics.

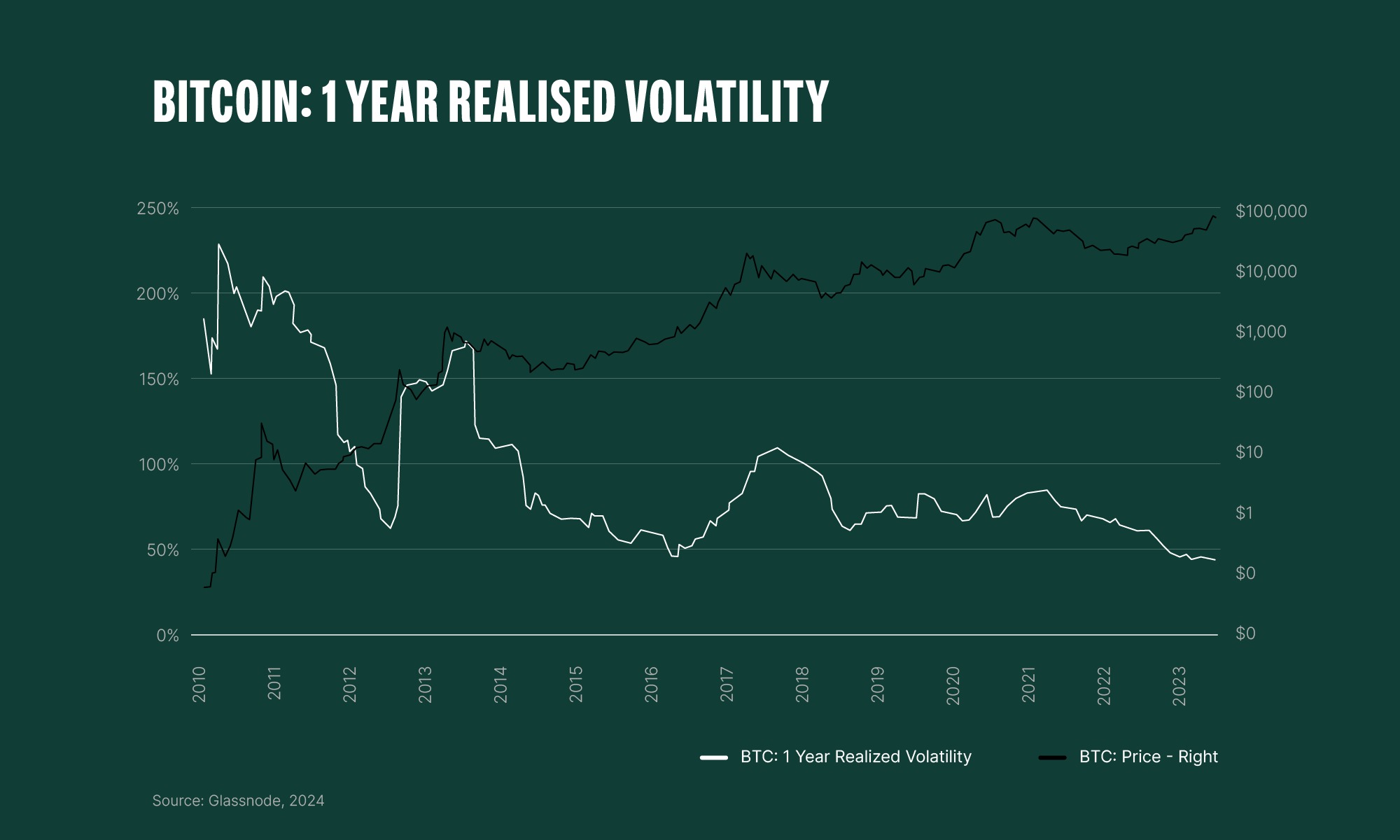

1. Bitcoin (BTC) reduced volatility

The initial high volatility materially diminished over time (from over 200% to around 50-60%). At the same time, the opportunity (price increase) continued to rise in a way that sufficiently offset higher price fluctuations. And, even if Bitcoin drops more than 50% from its current price, this will be an opportunity to gain more exposure to the asset.

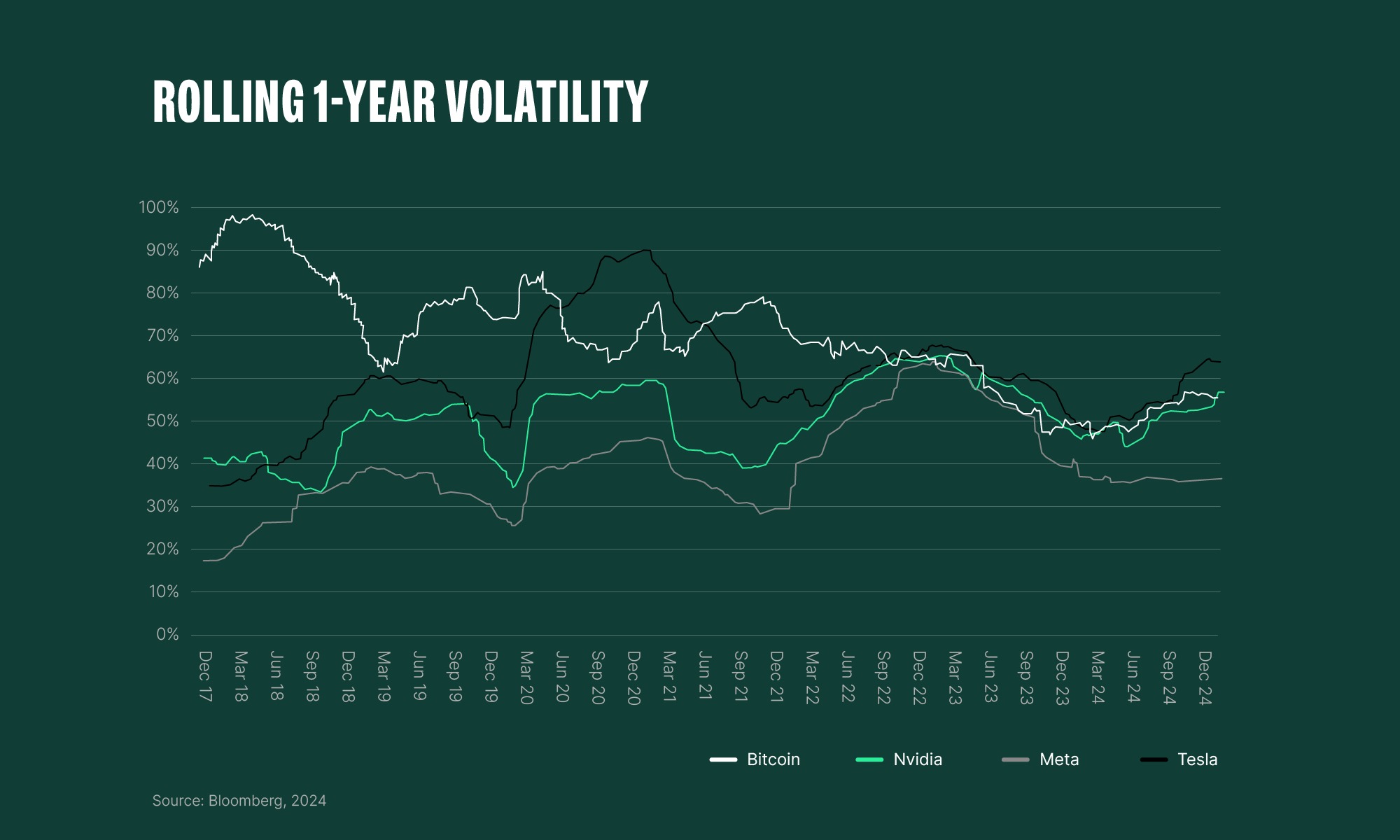

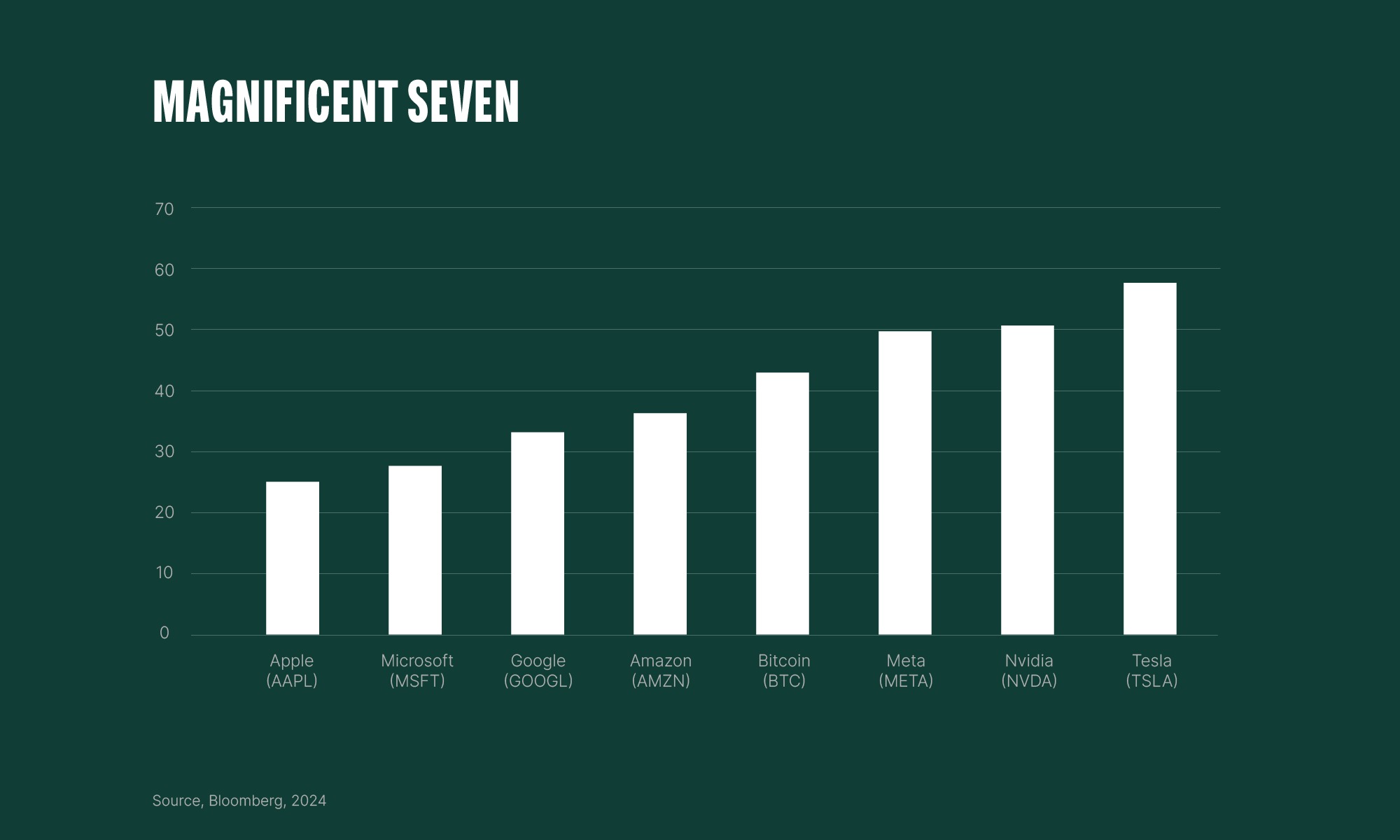

2. Volatility compared to the stock market

As of January 31, 2025 (Bloomberg,) Bitcoin volatility is approximately 54% vs. 15.1% for gold and 10.5% for global equities (here, volatility calculated as the annualised standard deviation of the last 1-year of daily returns). To put it differently, Bitcoin’s volatility is 3.6 times more than for gold and 5.1 times more for global equities. Notably, by comparing Bitcoin to high-volatility tech assets, it is evident that the gap has become smaller in recent years. Bitcoin's average annual volatility is only 1.09 times higher than Tesla's (32.54%) and 1.17 times higher than NVIDIA's (30.42%) (Forbes). There were even moments when the S&P 500 was more than or equal to Bitcoin’s volatility.

Unexpectedly to most observers, Bitcoin showcased growth in stability in relation to other assets - that was, interestingly, the case during the tariff trade wars (which are still on at the time of writing). If we take a closer look, between February 20, 2025 and April 8, the S&P 500 dropped 19% and recovered by September 3 by around 29%. BTC, in contrast, dropped about 22-24% during that period, while recovering by 46%. Moreover, on February 20, 2025, the crypto market cap was valued at $3.19T, dropping to $2.42T on April 9. At the time of this writing, it is valued at $3.87T (it reached $4.17T on August 14).

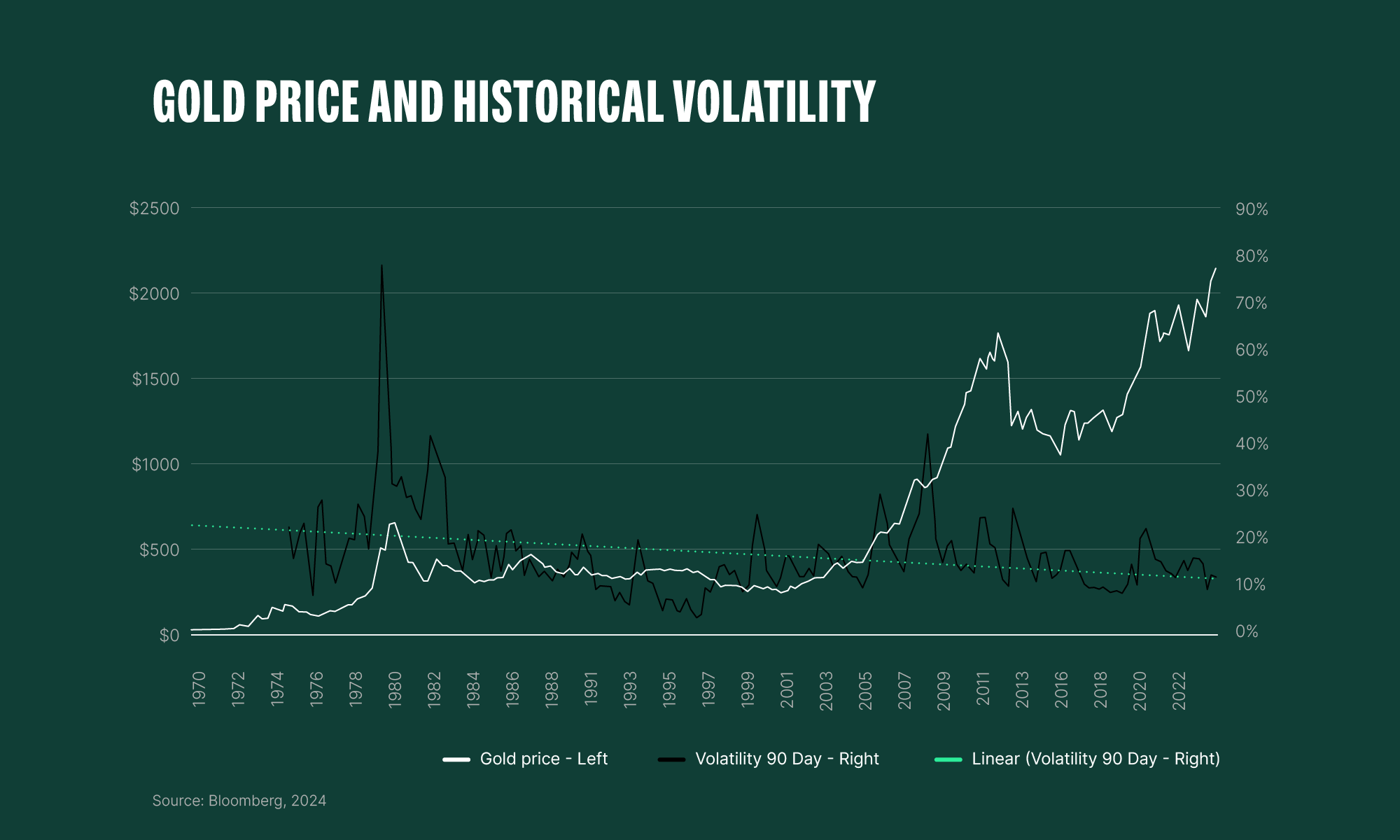

3. Gold prices fluctuated in the past

By exploring the historical performances of different assets, we can see that they also experienced higher price discovery before settling down and becoming less volatile. Gold is a good example of this. The price of gold dramatically rose after being de-pegged from the US dollar in 1971, and individuals could freely accumulate it after a decades-long ban.

As mentioned, any investment is by default risky and uncertain. Investors need to educate themselves, be cautious, apply risk mitigation strategies, define their risk tolerance, and be conscious about the characteristics of a product and market they are entering. Investors need to carry expectations of both failure and success. Moreover, emotional discipline is very important so as not to fall into the “get rich quick” mindset. Such an approach will help to maximise success and minimise losses, and it should be encouraged.

Once we move past the noise and examine the 'doomsday-like' claims about harmful volatility and speculation, it becomes clear that the facts and objective information are substantially different from what the public sees. As we saw, there are pros and cons of elevated volatility and speculation. However, if performed correctly, it can bring more positives than negatives. By bluntly discouraging or prohibiting investments in emerging assets, there is the potential for harming the market in the long run, as well as investor opportunities and entrepreneurship growth.

Let’s consider this myth demystified!

Disclaimer

This article is distributed for informational purposes, and it is not to be construed as an offer or recommendation. It does not constitute and cannot replace investment advice. Bitpanda does not make any representations or warranties as to the accuracy and completeness of any information contained herein. Investing carries risks. You could lose all the money you invest.

We use cookies to optimise our services. Learn more

The information we collect is used by us as part of our EU-wide activities. Cookie settings

As the name would suggest, some cookies on our website are essential. They are necessary to remember your settings when using Bitpanda, (such as privacy or language settings), to protect the platform from attacks, or simply to stay logged in after you originally log in. You have the option to refuse, block or delete them, but this will significantly affect your experience using the website and not all our services will be available to you.

We use such cookies and similar technologies to collect information as users browse our website to help us better understand how it is used and then improve our services accordingly. It also helps us measure the overall performance of our website. We receive the date that this generates on an aggregated and anonymous basis. Blocking these cookies and tools does not affect the way our services work, but it does make it much harder for us to improve your experience.

These cookies are used to provide you with adverts relevant to Bitpanda. The tools for this are usually provided by third parties. With the help of these cookies and such third parties, we can ensure for example, that you don’t see the same ad more than once and that the advertisements are tailored to your interests. We can also use these technologies to measure the success of our marketing campaigns. Blocking these cookies and similar technologies does not generally affect the way our services work. Please note, however, that while you’ll still see advertisements about Bitpanda on websites, the adverts will no longer be personalised for you.