- Chainlink connects off-chain, “real” world data with the blockchain using hybrid smart contracts, which are considered to be especially secure.

- Chainlink holds potential for individuals and businesses that want to leverage the security and transparency of blockchain technology.

- LINK, the currency issued by the Chainlink network, is an ERC20 token that is paid to network participants who help with transfers.

- The Chainlink price reached its all-time high of €42.92 on May 9, 2021.

What is Chainlink?

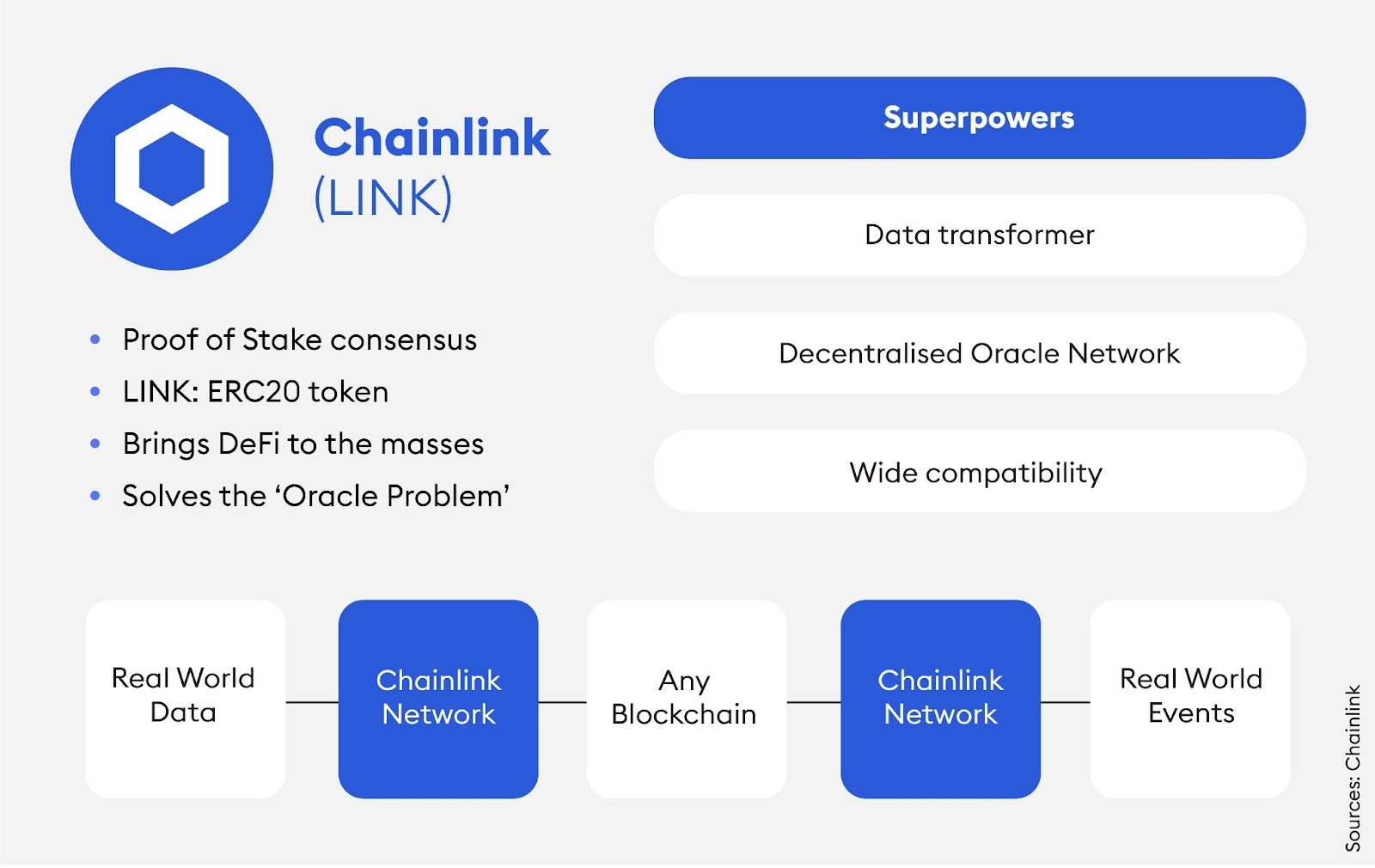

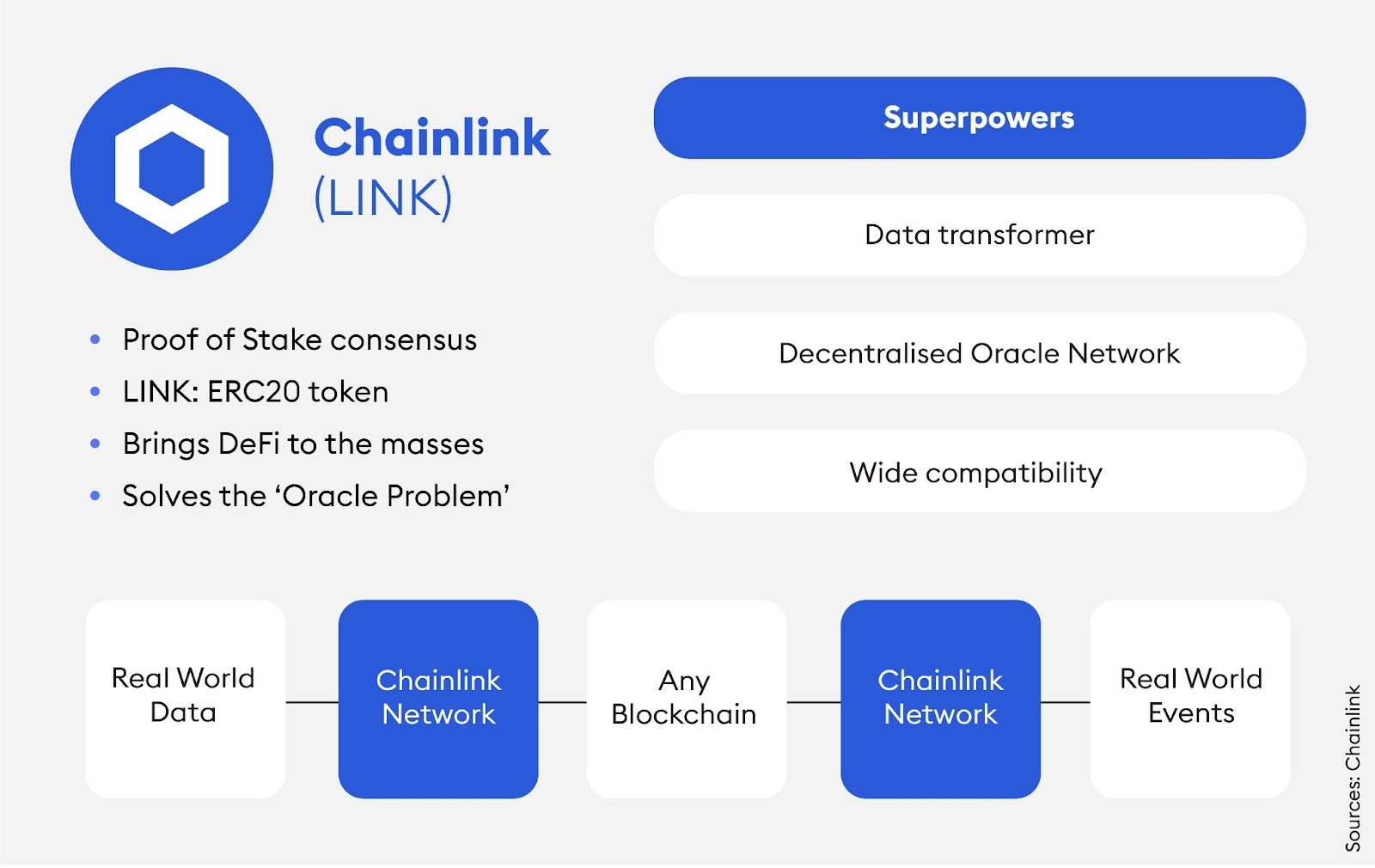

Chainlink is a decentralised network running on Ethereum that securely links real-world, off-blockchain data with the blockchain. Participants in the Chainlink network are compensated in LINK tokens for fulfilling data transfer requests. As Chainlink is decentralised, it’s considered to be a safe and secure way to connect many types of external data with different blockchains. This makes it appealing to many industries and businesses who want to connect their information with blockchain technology.

How does Chainlink work?

Chainlink works like a trustworthy translation agency: any blockchain can be sure that the data coming from its oracles (which function like individual translators) is properly transformed, validated by the Chainlink network, and ready to use on-chain. While smart contracts are not able to access resources such as data feeds, web APIs or data on traditional bank accounts on their own, the Chainlink project aims to facilitate access by connecting its nodes to external information and transferring that data to its decentralised network. Participants in the Chainlink network are compensated in LINK tokens for keeping Chainlink nodes online and fulfilling data transfer requests.

Image courtesy of Chainlink.

How to buy LINK?

You can buy Chainlink through cryptocurrency exchanges like Bitpanda using fiat currencies, e.g. euros or U.S. dollars. It’s a good idea first to get familiar with the LINK price history and the current exchange rate. Once purchased, your Chainlink investment can be viewed and accessed in a digital wallet similar to a banking app. You then have the option to hold on to your LINK or sell it again via the exchange.

LINK price history

Like other cryptocurrencies, Chainlink is considered a highly volatile asset. Its price has fluctuated through highs and lows throughout its existence, and there’s no way to make a guaranteed LINK price prediction. As always, it’s important to do your own research before investing in crypto.

Since its launch in 2019, Link’s price has grown over the years, reaching its all-time price high on May 9, 2021, at €42.92. Though it has dipped a lot since then, LINK recovered from the crypto crash in the summer of 2021, trading at around €20 for the rest of that year. Currently, LINK is trading at an average daily high of €7.8141 and an average daily low of €7.2933. The supply of LINK is capped at 1 billion tokens.

How to use Chainlink?

Blockchain technology is appealing for businesses, institutions and individuals for several reasons: It’s decentralised, meaning no single entity owns or controls it. Everyone has equal access to it and the programs and services running on blockchain technology cannot be tampered with, making it a secure and reliable public platform. With this in mind, here are the top use cases for Chainlink.

Decentralised Finance (DeFi)

Chainlink developers are creating their own decentralised version of traditional financial products, like payments and loans, using Chainlink’s intricately connected platform to provide a wealth of useful financial information. Compared to traditional financial products, DeFi applications are more transparent, but also more secure, thanks to blockchain technology.

Insurance

Chainlink smart contracts have various use cases of their own, including parametric insurance contracts. One notable example is the Arbol crop insurance market. As Chainlink writes on its website, these smart insurance contracts enable “farmers all over the world to obtain parametric crop insurance simply with an Internet connection, which is settled in a fair and timely manner according to the amount of rainfall, temperature, or other evaluators the policy is set to.”

Gaming

Like other smart contract platforms, Chainlink provides a space for developers to create and launch their games as well as offer unique NFT collectibles. Games developed on the blockchain are special because many of them incorporate randomness in order to generate randomised game place actions so that the experience is new and fresh for each user. Chainlink’s randomness building block is called VRF, which stands for Verifiable Random Function.

Commodities* Invest in commodities 24/7

Commodities* Invest in commodities 24/7 BITCOIN What to know when you are just starting to invest

BITCOIN What to know when you are just starting to invest ASSET MANAGEMENT Your investment, your assets: Why your money is safe with Bitpanda

ASSET MANAGEMENT Your investment, your assets: Why your money is safe with Bitpanda COUNTDOWNBitcoin Halving Countdown 2024

COUNTDOWNBitcoin Halving Countdown 2024 ACADEMYWhat is the Bitcoin halving?

ACADEMYWhat is the Bitcoin halving?