Education • 10 min read

By Bitpanda

17.02.2026

After a period of strong gains, the crypto market shifted into reverse at the end of 2025. A considerable Bitcoin dip and even sharper declines for some altcoins had some investors worried: Was this simply a healthy correction, or a sign of broader problems? Let’s explore in more detail.

Key Takeaways:

Price pullbacks are not unusual for the crypto markets, but they rarely happen without reason

The correction at the end of 2025 was caused by a combination of market dynamics, macroeconomic influences, and changing sentiment

Understanding what is driving the current crypto market performance is important to put things into perspective

Short-term volatility is a sign of a healthy market and offers significant opportunities for investors

Bitcoin had pulled back noticeably in November of 2025, after reaching a local high:

On 7 October 2025, Bitcoin was trading at €106,662

By 22 November, it stood at around €73,119

This represents a drawdown of roughly 32% over a six-week period

This sharp decline increased volatility. Market participants were generally more nervous, especially after several months of strong gains.

While this correction may appear abrupt, it didn’t happen in a vacuum. Bitcoin’s pullback – and the general crypto market performance – was caused by a combination of factors: structural, macroeconomic, and sentiment-driven.

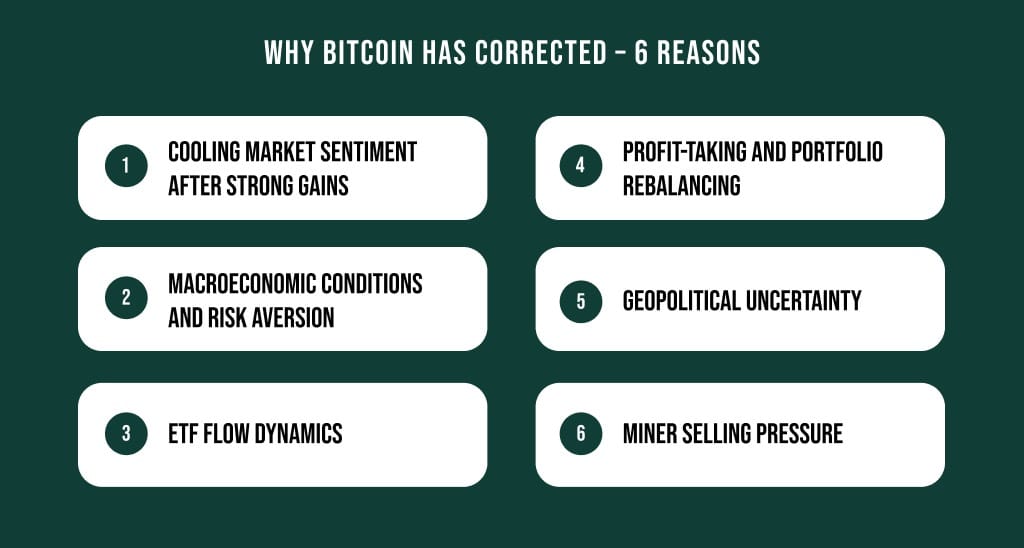

Together, they help explain why the market shifted so quickly. In total, six key reasons played a central role in the recent Bitcoin dip:

One of the main drivers behind the recent Bitcoin dip was a general cooling of the market sentiment. This is a natural reaction to the period of strong gains we’ve seen in past months. No market can increase indefinitely without a correction phase.

With the rising prices came strong optimism from investors. Profit-taking became much more attractive as well: More and more market participants started selling in order to realise their gains.

The upward momentum began to slow down, and market sentiment quickly shifted to a more cautious stance. With this in mind, the recent Bitcoin dip can be seen as a response to that change in opinion. A change such as this is a common occurrence after a period of strong crypto market performance.

The crypto market performance is closely connected to the world economy and global liquidity. Multiple factors can directly cause a Bitcoin dip:

If the outlook for the global economy darkens, crypto market performance usually suffers as well. This is because investors had certain expectations for better monetary conditions, and become cautious when those don’t materialise.

But it is important to remember that this represents a negative outlook on the general economy and not necessarily on the crypto market. Bitcoin and altcoins are collateral damage in this wider process. Even strong assets can temporarily be caught in this development.

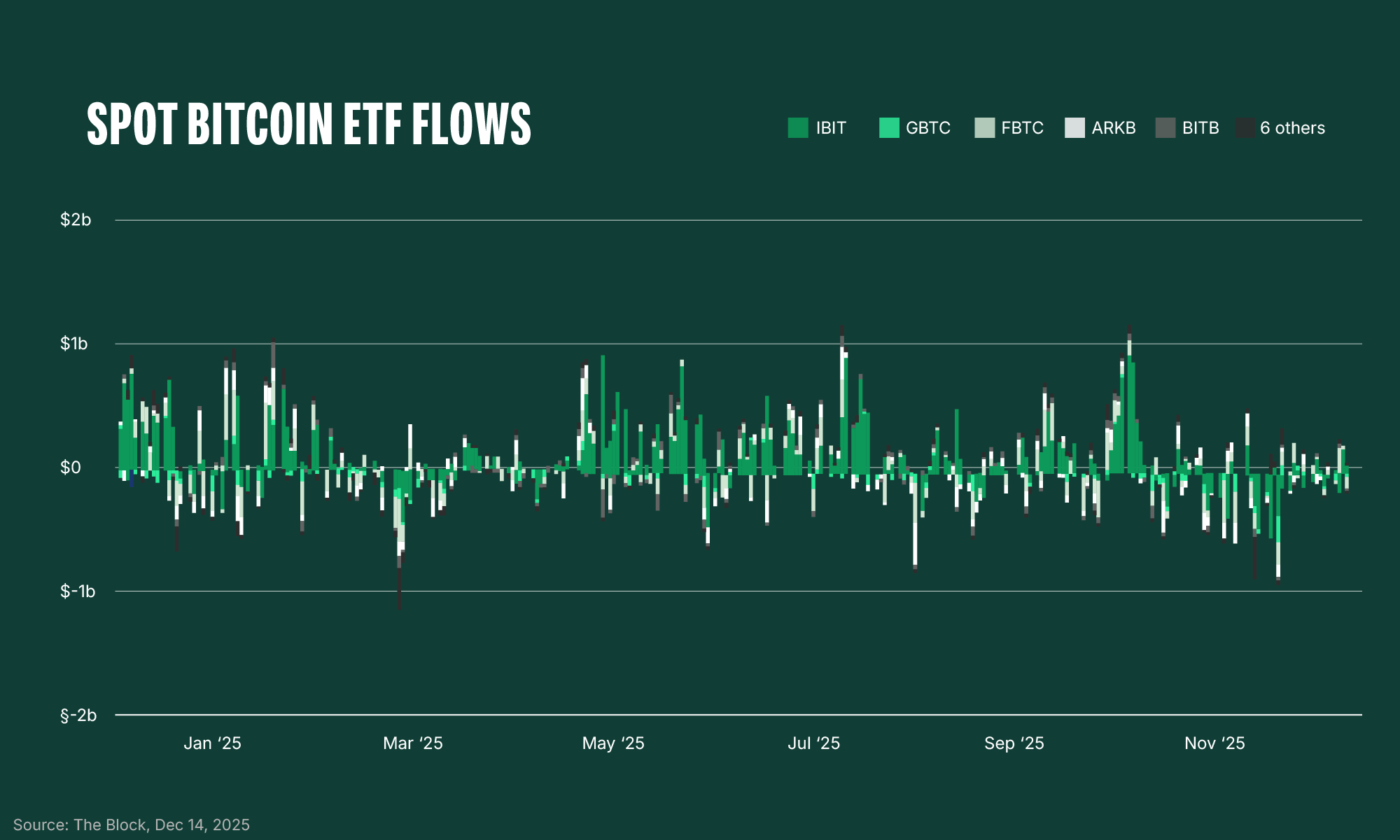

Bitcoin ETFs are essential cornerstones of the crypto market: combined, they hold a hefty €100 billion in Bitcoin investments. Naturally, movements in those funds can have a strong effect on general crypto market performance:

This change, from steady inflow to strong outflow, shows how quickly the market sentiment can shift. By the end of November, opinions had changed once again, and investors added €60 million back to their Bitcoin ETFs.

This shows that the typical crypto cycles appear within Bitcoin ETFs as well. ETF outflows in November accelerated the recent Bitcoin dip and the overall declining crypto market performance.

With increasing gains after a month-long price rally, profit-taking becomes increasingly likely. Both institutional and retail investors want to realise their gains, knowing that a Bitcoin dip becomes more and more probable. This is an essential process and a main reason for movements in crypto markets.

Additionally, investors regularly rebalance their portfolios and adjust them for risks. Even though these actions are generally independent of the crypto market performance, they can have an accelerating effect on a downward movement. Rebalancing phases can be a significant contributing factor, especially in short-term price corrections.

Crypto market performance is not immune to global developments. The same geopolitical problems and tensions that shape the global financial market also have an effect on crypto:

During times of heightened uncertainty, investors are more likely to reduce risk by selling off positions in cryptos and other assets. Naturally, this can have a negative effect on Bitcoin and altcoin prices, even without any particular crypto-specific reason.

Bitcoin miners are the backbone of the crypto world, but their hardware needs upgrades to stay competitive, and operational costs for energy and infrastructure have to be covered. Therefore, they have to regularly sell a portion of their holdings to cover their expenses.

Normally, this is a continuous process that has little to no effect on crypto market performance. But in November 2025, two important factors came together:

Both aspects together led to a higher-than-usual sell rate from crypto miners. The effect, combined with the changing sentiment of investors and reduced liquidity, amplified the already developing Bitcoin dip.

The Bitcoin correction quickly spilled over into the wider altcoin market, and caused even more severe price declines. This reflects a well-established market dynamic: while altcoins often outperform Bitcoin during upward movements, they tend to underperform during corrections.

This correlation is caused by a number of reasons:

Together, these dynamics help explain why Bitcoin-led corrections frequently result in disproportionately large drawdowns across the altcoin market.

Several large-cap altcoins have recorded significantly deeper drawdowns than Bitcoin during the November dip. While the exact magnitude varies, the underlying causes are very similar.

Solana entered the correction after a period of strong outperformance and by September was trading close to its all-time high. From those levels, the token had declined by almost 50%.

Once the sentiment of the market had changed, the high trading volumes and speculative nature of investments in altcoins amplified the downturn.

In addition, parts of Solana’s recent rally had been driven by news around ecosystem activity and memecoin trading. As risk appetite faded, these became less appealing and contributed to the increasing volatility.

Avalanche had fallen over 60% from its recent high in September, underperforming Bitcoin during the correction. The decline reflects a broader cooling across layer-1 ecosystems: Investors are increasingly bearish about long term growth and tend to focus on capital preservation instead.

Lower short-term network activity and less liquidity added to the selling pressure. AVAX remained closely tied to the Bitcoin dip, but with an increased downward movement.

Cardano’s drawdown had been more severe than other altcoins, with up to 60% loss from its September high. This dip comes despite the fact that ADA was considered a long-term development token rather than a short-term asset.

During corrections, this profile can actually work against the coin. As sentiment weakens, capital often rotates away from assets perceived as slower-moving, even when fundamentals remain unchanged. As a result, ADA struggled to attract demand during the downturn.

Polkadot, too, had experienced a significant drawdown of almost 60% since September. This reflected both a market-wide pressure and ecosystem-specific challenges. Sentiment around adoption and network growth had softened, reducing interest from investors.

In addition, token supply dynamics and lower trading activity contributed to this downturn.

Chainlink declined by roughly 50% from its recent highs, despite its established role in crypto infrastructure. Earlier in the cycle, LINK showed relative resilience as positive news around its infrastructure gained traction.

As the crypto market performance declined and risk appetite weakened, however, this faded quickly. With the market shifting away from risky altcoins and nothing to increase investor interest, LINK ultimately followed the broader downturn despite unchanged long-term fundamentals.

Several broader market themes were highlighted by the recent Bitcoin dip and altcoin dip. Together, they help explain why the downturn unfolded so broadly and why price movements across crypto became increasingly synchronised.

Market corrections have always been part of Bitcoin’s history. Phases of strong price appreciation have repeatedly been followed by pullbacks. The main reasons for a Bitcoin dip have always been changes in liquidity, market sentiment, and investors’ appetite for risk.

It is, however, important to point out that Bitcoin correction is generally not caused by a change in crypto's important role in the financial market.

Altcoins, which similarly suffered from steep losses, followed their usual pattern: they outperform Bitcoin in bullish markets, but underperform in bearish phases.

Historical data illustrates this pattern clearly. While past market behavior does not guarantee future outcomes, it highlights that crypto market performance bounces back after each downturn.

This particular Bitcoin dip was no different. It was caused mainly by:

Viewed in this context, the November correction appears less as an outlier and more as part of the natural crypto cycle. Even as Bitcoin continues to integrate into global financial markets, periods of volatility remain likely. But thanks to a more mature crypto market, a Bitcoin dip can offer attractive opportunities for investors.

Disclaimer

This article is distributed for informational purposes, and it is not to be construed as an offer or recommendation. It does not constitute and cannot replace investment advice.

Bitpanda does not make any representations or warranties as to the accuracy and completeness of any information contained herein.

Investing carries risks. You could lose all the money you invest.

We use cookies to optimise our services. Learn more

The information we collect is used by us as part of our EU-wide activities. Cookie settings

As the name would suggest, some cookies on our website are essential. They are necessary to remember your settings when using Bitpanda, (such as privacy or language settings), to protect the platform from attacks, or simply to stay logged in after you originally log in. You have the option to refuse, block or delete them, but this will significantly affect your experience using the website and not all our services will be available to you.

We use such cookies and similar technologies to collect information as users browse our website to help us better understand how it is used and then improve our services accordingly. It also helps us measure the overall performance of our website. We receive the date that this generates on an aggregated and anonymous basis. Blocking these cookies and tools does not affect the way our services work, but it does make it much harder for us to improve your experience.

These cookies are used to provide you with adverts relevant to Bitpanda. The tools for this are usually provided by third parties. With the help of these cookies and such third parties, we can ensure for example, that you don’t see the same ad more than once and that the advertisements are tailored to your interests. We can also use these technologies to measure the success of our marketing campaigns. Blocking these cookies and similar technologies does not generally affect the way our services work. Please note, however, that while you’ll still see advertisements about Bitpanda on websites, the adverts will no longer be personalised for you.