News • 5 min read

By Elisabeth Oberndorfer

16.06.2021

Dividend stocks also form part of the underlyings of Bitpanda Stocks. Learn how to build your own dividend strategy and what to look for in stocks below.

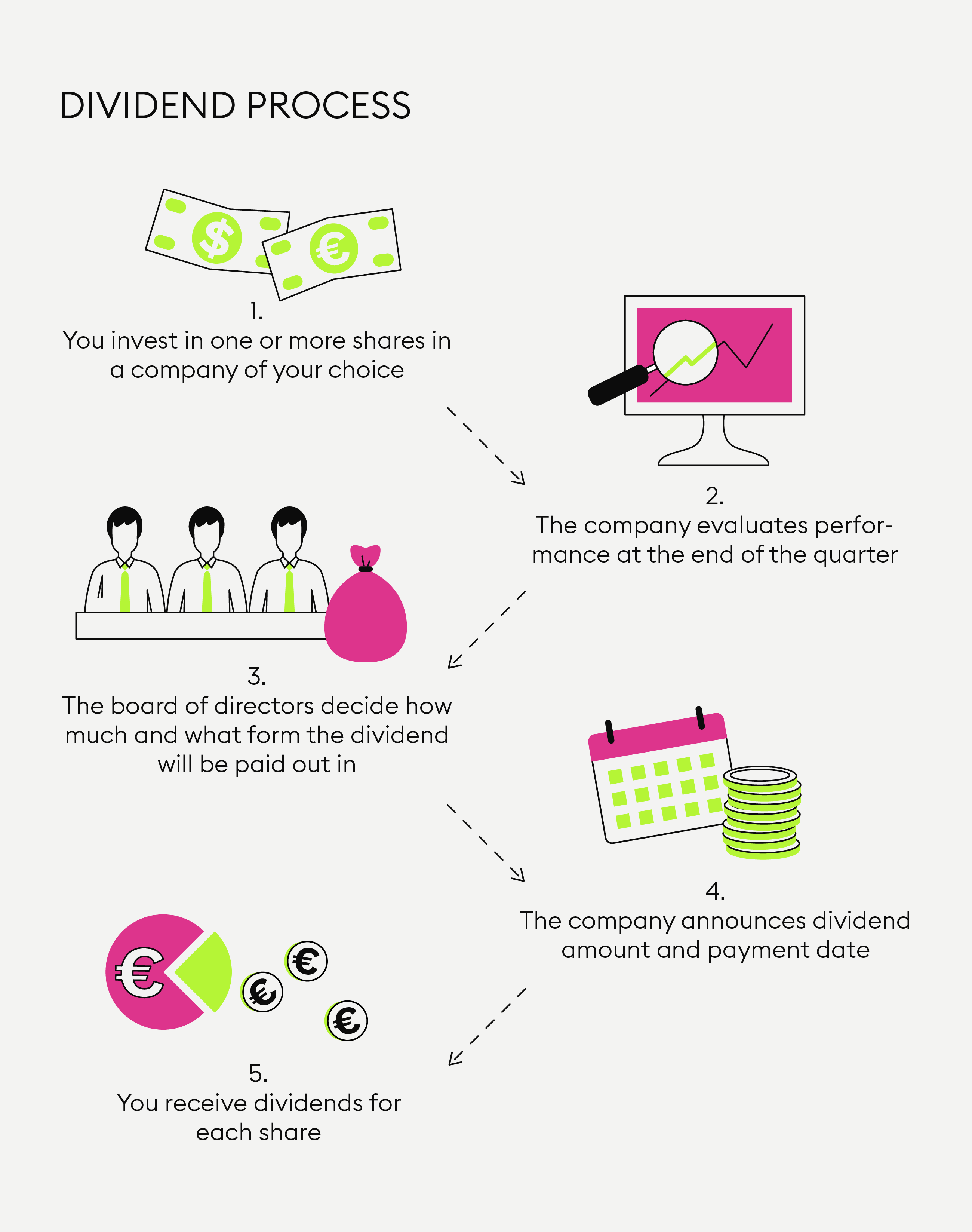

First things, first, what is a dividend? In short, dividends are earnings on stock investments. Shareholders are not actually entitled to dividend payments, as it is up to the issuing company to decide whether to distribute dividends or not. Whether a company distributes dividends or not depends on factors such as positive company performance or plans for a company to reinvest all their earnings for future growth to name a few.

Stock dividends are paid to shareholders depending on the number of shares they hold in a company. Dividends are usually paid once a year and on a quarterly basis, meaning four times a year. A healthy percentage of the profits used by a company for dividend payments is between 35% to 55%.

The exact percentage of profit a company distributes to its shareholders is determined at the annual general meeting which all shareholders are entitled to attend. The distribution of profits to shareholders usually takes place one day after the annual general meeting. If you want to learn more about the mechanics of dividend stocks, head on over to the Bitpanda Academy.

If you are interested in selecting some dividend stocks, here are some indicators you should pay attention to.

Dividend yield: This refers to the value of the annualised dividends in relation to the stock price. If a stock priced at €100 per share pays an annual dividend of €3 per share, the dividend yield is 3%.

Payout ratio: This shows the percentage of a company’s earnings which are paid out as dividends. If the company earns $2 per share and pays out $0.5 per share, the payout ratio is 25%.

When selecting a dividend stock, it’s tempting to focus on high dividend yields. However, these are not the only numbers you should pay attention to. If you want to build a sustainable dividend strategy, it is recommended to take a deep dive into the company’s financials, such as earnings, balance sheets and dividend payout history.

Let’s say you invested €2,000 in McDonald’s, which is one of the most popular dividend growth stocks and also available to invest in through Bitpanda Stocks*: Its dividend yield was 2.37% for 2020, so you would receive a payout of €47.40 for that year. Allianz, which is also available through Bitpanda Stocks, has an even higher dividend yield of 4.78%. For €2,000 worth of Allianz shares, you would earn €95.60 in dividends.

One of the most common strategies though is dividend growth investing. With this strategy, investors focus on companies that grow their dividends each year and value dividend growth more than dividend yield.

So-called dividend growers may provide some protection when market volatility rises, a study by S&P Global published in August 2020 has shown: “In summary, given the focus on quality balance sheets, dividend growth strategies could be attractive to market participants that are worried about volatility and the potential of rising rates, but still want to remain invested in equities while generating some income.” If you want to follow this strategy instead of going for high-yield stocks only, check the dividend history of the company and dividend growth rate.

When you receive dividend payouts, the choice is up to you: You can either reinvest in more shares of the company using the dividend, invest the money in other stocks or just spend or save the cash in other ways.

However, dividend investing has historically been seen as a long-term strategy to build up to over years or even decades and to then reap the rewards with monthly payments. As always, your investment strategy depends on a lot of factors, as well as your personal preferences and situation.

There are two things to keep in mind though: First, shareholders are not entitled to dividend payments, as it is up to the issuing company whether to distribute dividends or not, depending on factors such as positive company performance or plans for a company to reinvest all their earnings for future growth to name a few. So, while companies like Coca Cola have been paying dividends for decades, they could theoretically stop doing so anytime if their business were to take a nosedive. Second, certain taxation may apply depending on your country of residence. Please check your local tax law to learn more about how dividend payouts are taxed or not.

We recently launched fractional investing on Bitpanda through Bitpanda Stocks*, meaning you invest in a fractional share as an underlying. There are also some dividend stocks among our underlying stocks and by investing through Bitpanda Stocks, you are also eligible to participate indirectly, virtually and proportionally in the respective dividends. Some of the dividend stocks you can find in our Bitpanda Stocks offering are Starbucks, Apple, Adidas and the aforementioned McDonald’s. You can find their dividend details on their price pages.

If the company you invested in pays a dividend, its value will automatically be transferred to your Bitpanda account – note that each company’s general dividend terms and dates apply (you can find a list of upcoming corporate actions with regard to the underlyings that form part of Bitpanda Stocks and dividend distribution here). From there, you can choose to keep it in your wallet or reinvest it.

Get started with Bitpanda Stocks!

*Bitpanda Stocks are contracts replicating an underlying stock or ETF. More information is available at bitpanda.com. This article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

We use cookies to optimise our services. Learn more

The information we collect is used by us as part of our EU-wide activities. Cookie settings

As the name would suggest, some cookies on our website are essential. They are necessary to remember your settings when using Bitpanda, (such as privacy or language settings), to protect the platform from attacks, or simply to stay logged in after you originally log in. You have the option to refuse, block or delete them, but this will significantly affect your experience using the website and not all our services will be available to you.

We use such cookies and similar technologies to collect information as users browse our website to help us better understand how it is used and then improve our services accordingly. It also helps us measure the overall performance of our website. We receive the date that this generates on an aggregated and anonymous basis. Blocking these cookies and tools does not affect the way our services work, but it does make it much harder for us to improve your experience.

These cookies are used to provide you with adverts relevant to Bitpanda. The tools for this are usually provided by third parties. With the help of these cookies and such third parties, we can ensure for example, that you don’t see the same ad more than once and that the advertisements are tailored to your interests. We can also use these technologies to measure the success of our marketing campaigns. Blocking these cookies and similar technologies does not generally affect the way our services work. Please note, however, that while you’ll still see advertisements about Bitpanda on websites, the adverts will no longer be personalised for you.