What is leverage trading

In investing, leverage is a strategy to increase potential return on investments. The reason why investors engage in leverage trading is straightforward. It’s a way for them to potentially profit from price movements beyond normal trading where you simply buy and hold an underlying asset.

If investors leverage their buy position - so called long leverage - they can potentially make higher profits from upward price movements. There is also a way to profit from downward price movement of an underlying asset. Investors who believe a certain underlying asset may decrease in value open a leveraged short position - so called short leverage. The downside of it is clear: if prices go in the opposite direction to the leveraged position, losses also realise quicker than trading without leverage.

What is Bitpanda Leverage and what does it offer?

Bitpanda Leverage currently offers eleven 2* x long positions, and two 1 x short positions. Long Leverage means you can open a 2*x Long position on the top crypto , the performance of which is double* the underlying crypto asset. While Short Leverage means the performance of your position is the inverse of the underlying crypto asset. For example, if Bitcoin price goes up 10%, the price of Bitcoin 1x Short will decrease 10% and the price of Bitcoin 2x Long will go up to 20%*. Put simply, this means you can open a short position on an underlying cryptocurrency if you think crypto price could go down, or a long position if you expect prices to rise.

How leverage trading works

With traditional leverage products, investors are able to lay down a deposit that’s smaller than the actual trade amount in order to open a much larger position. This is because most of the money is initially contributed by the broker. In return, brokers usually demand a margin call from investors, meaning proof of funds equal to the borrowed amount. That margin in leverage trading products is not protected.

How does Bitpanda Leverage work?

Bitpanda Leverage is a CFD, or Contract for Differences. Bitpanda Leverage contains a margin close out protection with a trigger of 50% of the initial margin. This means that a position will be automatically closed if a 50% loss has been incurred. A negative balance protection ensures that potential losses of your position are capped at the original amount you invested into Bitpanda Leverage.

CFDs are a product that acts as an agreement between an investor and a broker, in this case, Bitpanda. CFDs give investors the chance to potentially profit from price movement of a specified cryptocurrency without owning the underlying asset. CFDs can provide access to an underlying asset at a lower cost and offer the option to go long or short, but they also come with significant risk of losses.

Benefits of Bitpanda Leverage

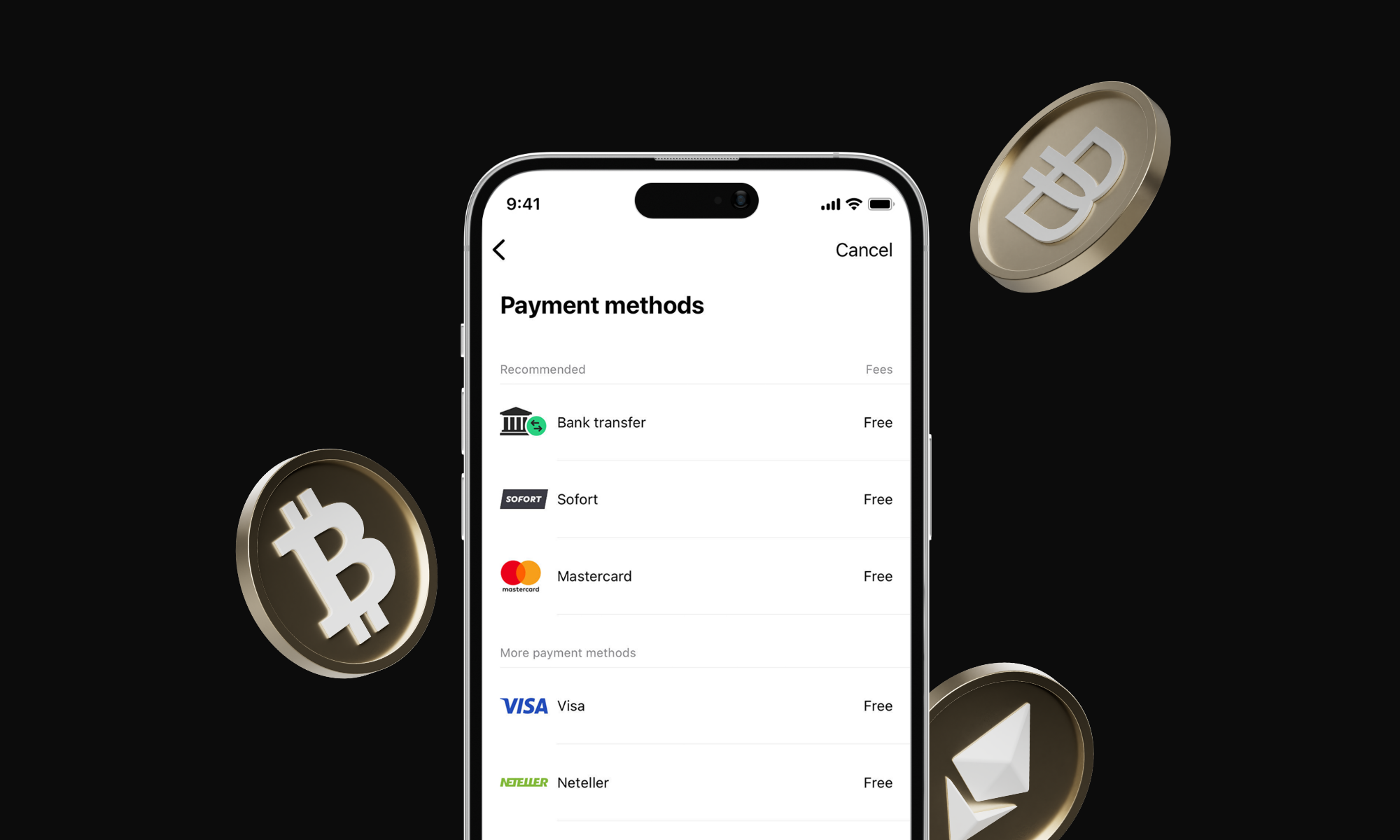

We make leverage trading straightforward, with the option to go 1x short and 2*x long on 11 cryptocurrencies. Plus:

- Make short-term volatility work for you: Independently trade in the crypto market if prices go up or down.

- Controlled risks: by re-leveraging on your behalf - at least once per day - we help maintain the target leverage ratio.

- Lower fees: Buy fee for leverage positions is 0%. A return fee of 1% is charged when closing leverage positions. A daily overnight fee of 0.1% on the leveraged amount will be charged.

Try Bitpanda Leverage now.

Disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts lose money when trading in CFDs. You should consider whether you can understand how CFDs work and whether you can afford to take the high risk of losing your money.

Bitpanda Financial Services GmbH, and Bitpanda GmbH of Stella-Klein-Löw-Weg 17, 1020 Vienna, Austria, are licensed and regulated by the Financial Market Authority, Austria, (license number GW5000.970/0006-PGT/2019 and W00861/0001-WAW/2020 respectively).

The present does not constitute investment advice. Past performance is not an indication of future results.

You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before trading. Under no circumstances shall Bitpanda have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Commodities* Invest in commodities 24/7

Commodities* Invest in commodities 24/7 BITCOIN What to know when you are just starting to invest

BITCOIN What to know when you are just starting to invest ASSET MANAGEMENT Your investment, your assets: Why your money is safe with Bitpanda

ASSET MANAGEMENT Your investment, your assets: Why your money is safe with Bitpanda COUNTDOWNBitcoin Halving Countdown 2024

COUNTDOWNBitcoin Halving Countdown 2024 ACADEMYWhat is the Bitcoin halving?

ACADEMYWhat is the Bitcoin halving?