Education • 9 min read

By Brinsley Bailey

30.10.2025

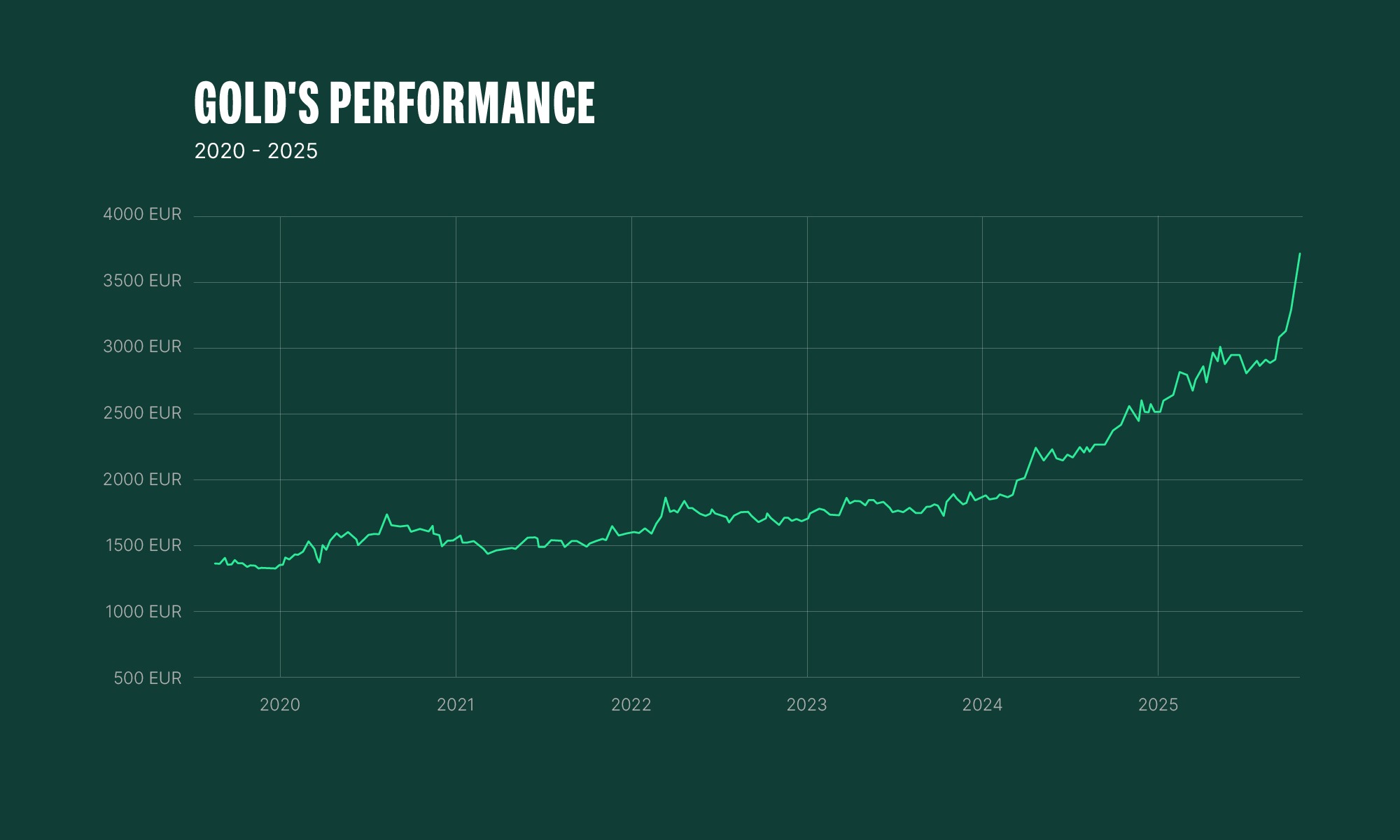

Since 2020, investors have witnessed remarkable growth across both digital and physical assets. While Bitcoin has broken through its all-time highs to reach dizzying new heights, precious metals such as gold and silver have also experienced significant gains. Macroeconomic uncertainty, inflationary pressures, and industrial demand have impacted both assets. But what if you had chosen gold instead of Bitcoin back in 2020? In this article, we explore what might have happened if you had invested in gold compared to Bitcoin and reveal how your portfolio could look today.

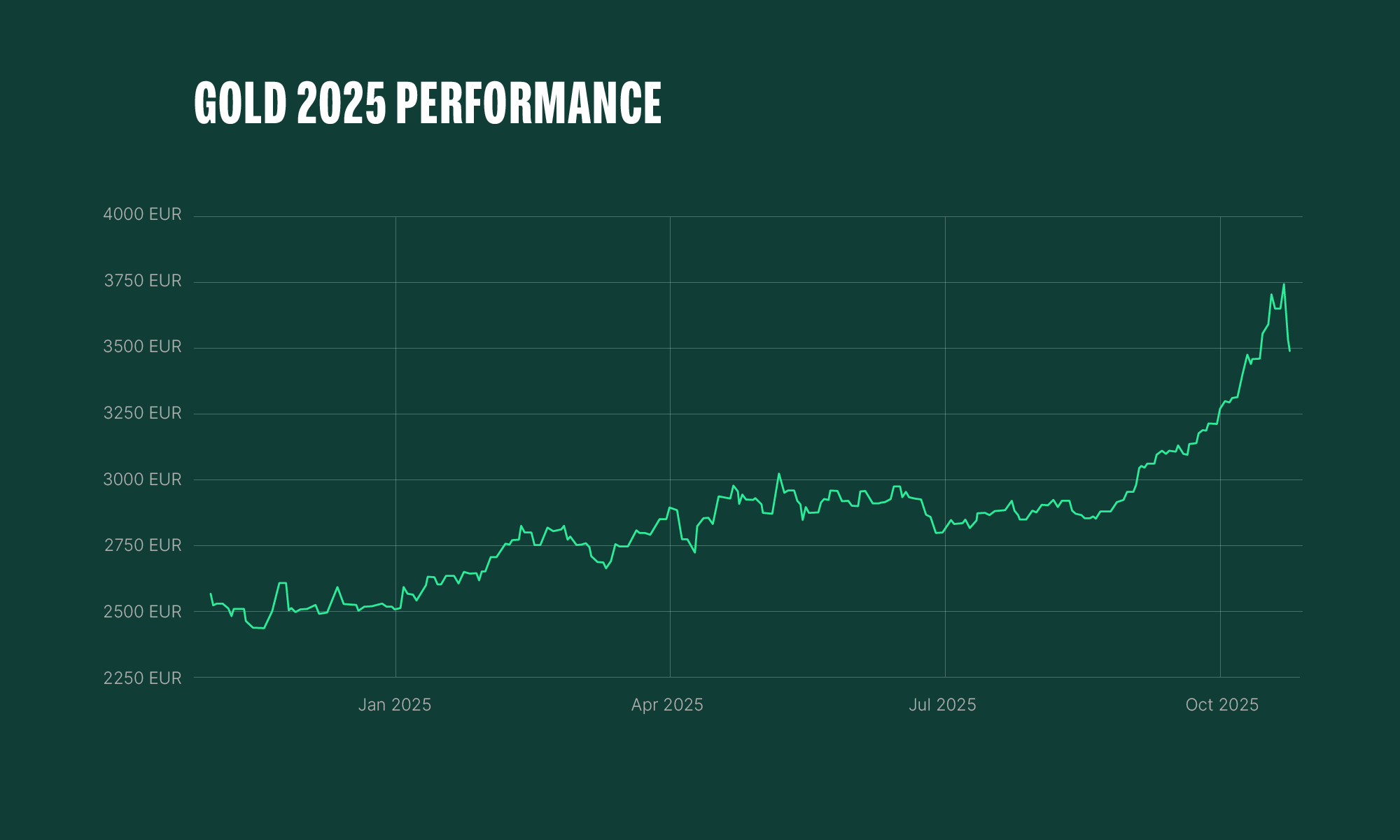

Throughout the year, Gold has continued to surge past historic milestones, gaining over 60% and reaching an all-time high of US$4,381/oz (€3,770) on October 20th, 2025. In fact, it’s on target to mark its strongest performance in a calendar year since 1979.

With central banks worldwide cutting interest rates, geopolitical tensions rising, and inflationary pressures persisting, investors are once again turning to Gold as a hedge against instability and currency devaluation. Moreover, central banks, sovereign funds, and other institutional investors have expanded their gold holdings in 2025, with several Asian countries driving demand as confidence in the U.S. dollar’s long-term resilience.

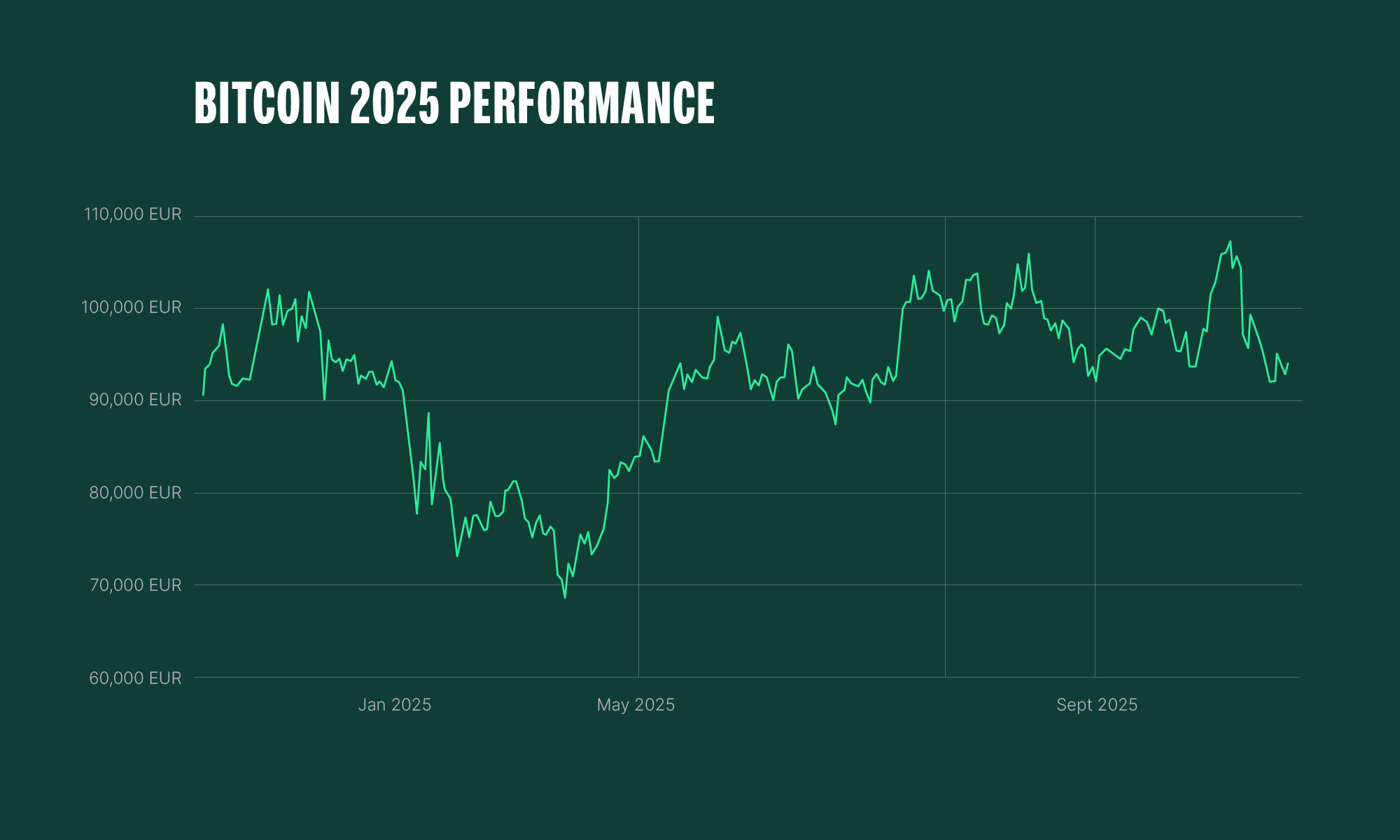

In 2025, Bitcoin has continued to capture worldwide attention by climbing to new all-time highs above $120,000 (€106,000) before entering a period of consolidation. Strong inflows into spot Bitcoin ETFs, alongside persistent retail demand, have supported its price despite a more cautious macroeconomic backdrop. Bitcoin’s institutional adoption remains a dominant theme, with ETFs, asset managers, and pension funds now treating it like a long-term allocation rather than a speculative trade. Although price volatility persists, Bitcoin’s 2025 performance underlines its growing reputation as a digital store of value and a complementary component to a diversified portfolio.

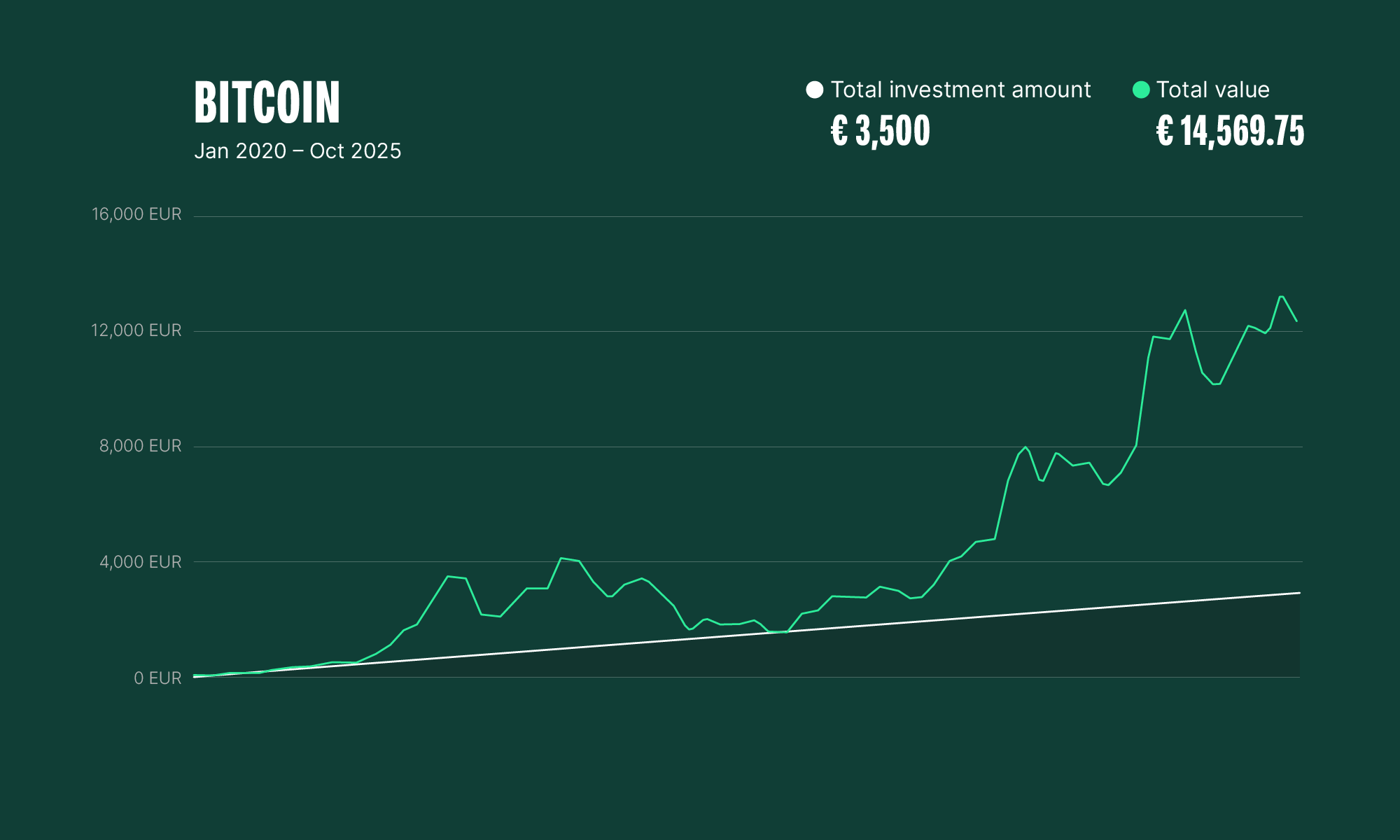

Let’s explore a hypothetical scenario of investing €50 weekly* into Bitcoin or Gold at the beginning of each year, starting from 2020. By steadily adding to a position, recurring contributions can potentially accumulate into a meaningful portfolio through periods of volatility, macroeconomic change, and market growth. This regular investment reflects the power of cost averaging, a simple and consistent approach to building exposure over time, without trying to predict market highs and lows.

*Note: All figures are rough estimates based on 0% commission and continued investment until October 2025. This analysis is for illustrative and educational purposes only. Calculations exclude transaction fees, spreads, and storage costs, and assume purchases occur at the monthly average price. Past performance is not indicative of future results, and this content does not constitute financial advice. This is for demonstration purposes only.*

Here’s how we’ll break it down:

Each scenario begins in January of that year, showing how the same investment behaviour might have performed in different market conditions. The data is based on historical average monthly prices, converted from USD to EUR using a fixed exchange rate of €1 = $1.16, for illustrative purposes only.

Remember, these examples are purely theoretical and exclude transaction fees, spreads, storage and custody costs, etc. They are intended to illustrate how a disciplined investment approach, rather than timing the market, can influence long-term outcomes.

In early 2020, markets opened to relative stability after a lengthy bull run. Global attention was focused on geopolitical flashpoints, including rising tensions between the US and Iran, and protests in Hong Kong testing UK–China relations.

Gold, traditionally a safe-haven asset, was already edging higher as central banks maintained ultra-loose monetary policies. Bitcoin, meanwhile, was consolidating after its 2019 rally, with limited institutional exposure. By March, the COVID-19 pandemic triggered a historic market crash and unprecedented monetary stimulus, setting both assets on divergent but transformative paths: gold surged as investors fled to safety, while Bitcoin began evolving into a potential hedge against monetary debasement.

A €50 per month gold investment from January 2020 to October 2025 would have nearly doubled in value, thanks to gold’s steady rise, especially the sharp climb from 2024 onward.

Investing € 50 worth of Bitcoin each month from January 2020 to October 2025 would have grown your holdings to 0.15719 BTC, worth around € 14,569.75, representing a +316.3% return. This is a vivid example of how consistent investing can capture long-term growth.

By early 2021, economies were recovering under extraordinary stimulus. Trillions in newly printed money drove inflation concerns, supporting gold prices, but risk appetite also soared. Bitcoin entered its first major institutional cycle, fuelled by high-profile treasury purchases from companies like Tesla and MicroStrategy, and the launch of the first US Bitcoin futures ETF. Later in the year, El Salvador adopted Bitcoin as legal tender, which further legitimised the cryptocurrency. Gold held steady during this period, but Bitcoin’s explosive rally pushed it briefly above $60,000, capturing headlines and reshaping investor perceptions of digital assets. Then, in December, Bitcoin’s market cap crossed $1 trillion for the first time.

2022 marked a dramatic shift in the macro environment. Inflation accelerated to multi-decade highs, prompting the US Federal Reserve and the European Central Bank to begin hiking interest rates. Rising real yields hurt gold’s short-term performance, though its defensive appeal remained intact. By contrast, Bitcoin entered a severe bear market as liquidity tightened and speculative capital retreated. The collapse of major crypto projects like Terra (UST) and exchanges such as FTX eroded confidence and triggered global regulatory scrutiny. Both gold and Bitcoin became mirrors of investor sentiment, the former as a haven, and the latter as a risk asset under stress.

Global markets began stabilising in 2023 as inflation cooled, though interest rates remained elevated. Recession fears lingered, supporting steady demand for gold from both central banks and investors seeking stability. Bitcoin had weathered the storm and started a slow recovery. Institutional focus shifted from speculation to infrastructure: clearer regulations, renewed ETF applications, and expanding custody solutions suggested that crypto was entering a maturation phase. While gold quietly posted consistent gains, Bitcoin’s gradual rebound indicated a reformed narrative of endurance.

January 2024 marked a watershed moment as the US Securities and Exchange Commission approved spot Bitcoin ETFs, opening the door to mainstream institutional investment. After years of anticipation, Bitcoin gained a credible bridge to traditional markets, and the approval cemented its place as a legitimate asset class in the eyes of many investors. Meanwhile, gold continued to benefit from lingering inflation, geopolitical uncertainty, and strong central bank demand. Both assets thrived in 2024; Bitcoin from innovation and access, and gold from trust and tradition.

During 2025, the global economy was defined by high debt, persistent inflation, and expectations of eventual interest-rate cuts. Markets coined a new term, ‘the debasement trade’, that reflects a shift toward hard assets like gold and Bitcoin amid fears of fiat currency erosion. Gold reached record highs, buoyed by central-bank buying of the precious metal at unprecedented rates. Bitcoin ETFs continued to attract institutional capital, further bridging the gap between digital and traditional finance. Both assets are seemingly now viewed similarly as scarce, borderless stores of value in an age of fiat currency excess.

By investing €50 each month from January to October 2025, a gold cost-averaging strategy would have potentially delivered a +20% return in just ten months, reflecting gold’s strong surge in mid to late 2025.

A €50 monthly investment in Bitcoin from January to October 2025 would have delivered a modest +3.5% return over ten months. While this result is less sensational than in earlier periods, it highlights that consistent investing can still yield results and keep you positioned for the next market move, even during quieter phases.

As we’ve outlined, both Bitcoin and Gold can play powerful roles in a well-balanced portfolio. Diversifying across asset classes helps spread risk and capture different forms of growth, especially when markets behave unpredictably.

Cost averaging remains one of the most effective ways to build that balance. By investing a fixed amount regularly, you can smooth out volatility and remove the pressure of trying to time the market. Over time, this steady approach can strengthen your position, whether you prefer traditional assets like Gold, digital assets like Bitcoin, or both.

It’s important to remember that no strategy is risk-free. Even with cost averaging, persistent downward trends can still affect returns. Yet for most long-term investors, the discipline of staying invested is more important than short-term market moves.

Start building your diversified portfolio today. Explore Bitpanda’s savings plan options and make steady investing part of your long-term growth strategy.

If this “What If?” got you thinking about the long-term power of investing in gold, here’s your chance to make it real. We’re giving away €45,000 in gold to 10 lucky Bitpanda users…that’s €4,500 in gold each!**

As a verified Bitpanda user**, you’re already eligible for one free entry.

To claim it, go to the campaign story in the Bitpanda app and opt in. Want to boost your chances? Simply buy at least €45 in precious metals (gold, silver, platinum or palladium) between October 20 and November 9, 2025, and you’ll earn one additional entry for every qualifying investment. More entries, more chances!

Winners will receive their gold directly to their Bitpanda wallet within 15 days of the promotion ending.

Start investing today for your chance to win!

Terms and conditions apply

**Please note that - due to regulatory requirements - the Promotion is not available to users in certain restricted jurisdictions (Bitpanda Clients with residence in Italy, Turkey, Luxemburg, Malta, Netherlands, Slovakia, Czech Republic, Romania, and in the UK). Investing in digital assets carries risks. In extreme cases, the invested amount may be lost completely. This Competition does not constitute financial advice or an invitation to conclude a transaction. You should keep yourself informed and understand the risks involved in buying and holding digital assets.*

Disclaimer

This article is distributed for informational purposes, and it is not to be construed as an offer or recommendation. It does not constitute and cannot replace investment advice.

Bitpanda does not make any representations or warranties as to the accuracy and completeness of any information contained herein.

Investing carries risks. You could lose all the money you invest.

We use cookies to optimise our services. Learn more

The information we collect is used by us as part of our EU-wide activities. Cookie settings

As the name would suggest, some cookies on our website are essential. They are necessary to remember your settings when using Bitpanda, (such as privacy or language settings), to protect the platform from attacks, or simply to stay logged in after you originally log in. You have the option to refuse, block or delete them, but this will significantly affect your experience using the website and not all our services will be available to you.

We use such cookies and similar technologies to collect information as users browse our website to help us better understand how it is used and then improve our services accordingly. It also helps us measure the overall performance of our website. We receive the date that this generates on an aggregated and anonymous basis. Blocking these cookies and tools does not affect the way our services work, but it does make it much harder for us to improve your experience.

These cookies are used to provide you with adverts relevant to Bitpanda. The tools for this are usually provided by third parties. With the help of these cookies and such third parties, we can ensure for example, that you don’t see the same ad more than once and that the advertisements are tailored to your interests. We can also use these technologies to measure the success of our marketing campaigns. Blocking these cookies and similar technologies does not generally affect the way our services work. Please note, however, that while you’ll still see advertisements about Bitpanda on websites, the adverts will no longer be personalised for you.