- The Zilliqa blockchain ecosystem focuses on increasing speed and throughput by employing sharding as a scaling solution.

- Zilliqa’s functionality is based on two algorithms, Proof-of-Work and practical Byzantine Fault Tolerance.

- ZIL is the native token of the Zilliqa platform and can be used for mining, staking rewards and paying transaction fees.

- The Zilliqa price reached its all time high of €0.1985 on April 16, 2021.

What is Zilliqa?

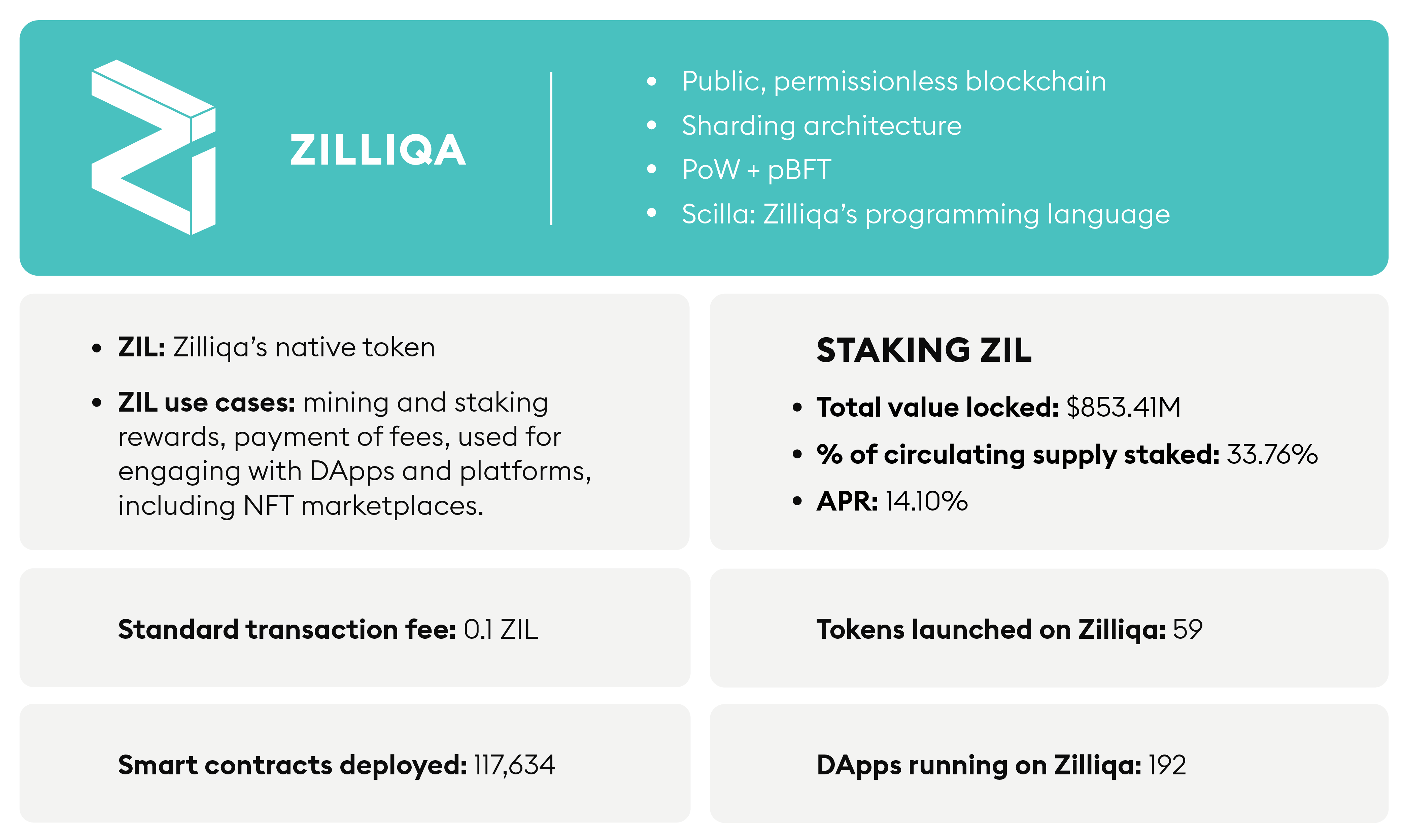

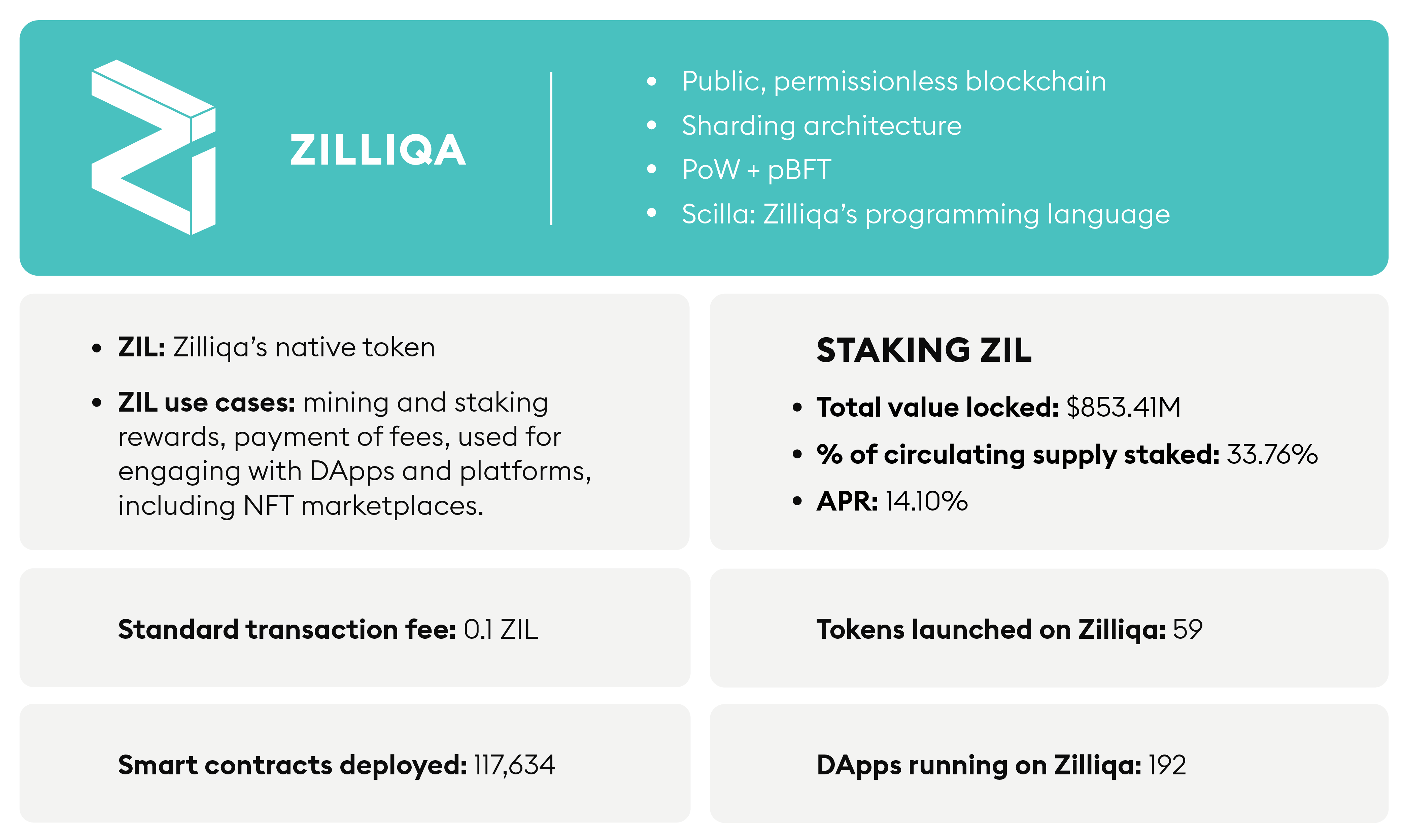

Scalability issues are common in the world of blockchain, so much so that the projects that were created to solve scalability issues are almost as old as blockchain technology itself. Zilliqa has adopted a unique approach to the problem by offering a permission-less, public blockchain with sharding as a Layer-2 scaling solution. This blockchain ecosystem focuses on increasing speed and throughput by employing sharding as a scaling solution.

Zilliqa aims to provide developers with a fast and efficient ecosystem where they can implement user-friendly DApps and smart contracts written in Scilla, which is the blockchain’s programming language.

The Zilliqa ecosystem already offers multiple features for developers and creators, employing a combination of Proof-of-Work and practical Byzantine Fault Tolerance protocol. It has also enabled the mining and staking of ZIL, Zilliqa’s native token, which is used for rewarding miners, executing smart contracts and validating transactions.

What is ZIL?

ZIL is the native token of the Zilliqa ecosystem. It is used for a wide range of purposes, from mining and staking rewards to the payment of transaction fees. It is also required to execute smart contracts and interact with all DApps and platforms on the blockchain, including in NFT marketplaces. In fact, NFTs can be sold and bought using ZIL. The fees paid in ZIL are stored in the blockchain for paying future mining rewards. This way, ZIL acts as a tool to keep the network secure.

How does Zilliqa work?

Zilliqa’s high throughput and speed are enabled by sharding. Simply put, sharding splits the network into several mini-blockchains called “shards”. Thanks to these shards, all data coming into Zilliqa's blockchain can be processed in smaller sections and shared asynchronously among the shards. Consequently, the workload of the blockchain gets spread across the shards and each of them takes care of a portion of the transactions that need to be processed. Each Zilliqa shard can process transactions in parallel with the others, making the system faster.

Sharding allows the network’s throughput to increase along with the size of the network: a bigger blockchain means more shards, and more shards mean more transactions that can be processed. Thanks to this architecture, Zilliqa claims to process more than one million transactions a month.

A group of shards that plays a particularly special role in the Zilliqa blockchain is the Directory Service (DS) committee. This group determines the shard memberships, assists with shard supervision and puts the results of the transaction validations together.

Proof-of-Work and practical Byzantine Fault Tolerance

There are two algorithms involved in the functionality of Zilliqa’s blockchain: Proof of Work and practical Byzantine Fault Tolerance (pBFT). The consensus in Zilliqa is reached by the shards through the pBFT protocol. This protocol is designed for asynchronous systems because it enables transaction finality, aids in distributing block rewards to miners and requires low-energy consumption.

So what role does Proof-of-Work play if pBFT takes care of consensus? Zilliqa uses Proof-of-Work as a type of entry test. The nodes that want to enter the blockchain and participate as shards need to solve the mathematical puzzle presented by the PoW. If they solve this test, they are allowed to be Zilliqa’s shards, participate in the network and get rewards. This use of the Proof-of-Work represents a security measure to protect the network from malicious attacks.

How to buy Zilliqa?

People who want to buy Zilliqa can do so through cryptocurrency exchanges like Bitpanda using fiat currencies, e.g. euros or U.S. dollars. It’s a good idea to first get familiar with the ZIL price history and the current exchange rate. Once purchased, your Zillliqa investment can be viewed and accessed in a digital wallet that acts similarly to a banking app. You then have the option to hold on to your ZIL or sell it again via the exchange.

Zilliqa price history

Like other cryptocurrencies, Zilliqa is considered to be a highly volatile asset and its price has fluctuated through many highs and lows throughout its existence. It is recommended that you conduct your own research before investing in cryptocurrencies.

Zilliqa has seen a varied price history since its launch in 2017. It reached its very first peak of €0.168 in May 2018. This was followed by its currently standing all-time high of €0.1985, reached on April 16, 2021. Currently, Zilliqa is trading at an average daily high of €0.0367 and an average daily low of €0.0334. The Zilliqa market capitalisation is €401.19 million.

How to use Zilliqa?

Zilliqa realised that, for blockchain technology to become truly mainstream, it needs to offer valuable use cases beyond its sharding architecture. In pursuit of widespread adoption of blockchain technology, Zilliqa wants to provide a safe space where developers and creators can implement a variety of decentralised applications and smart contracts, but also make use of platforms for monetising and decentralising content.

Developers on Zilliqa can create and implement DApps and smart contracts and launch tokens on the network. More than 110,000 smart contracts have already been deployed on the network, 192 DApps are running on the blockchain and 59 tokens have been launched. The programming language of Zilliqa is Scilla, short for “smart contract intermediate-level language”, which is a peer-reviewed smart contract language inspired by functional programming languages such as OCaml. The official website offers 31 lessons on how to code with Scilla, with elementary, intermediate and advanced classes.

For creators, the blockchain offers platforms and tools tailored to help them with growth and content monetisation. Zilliqa takes an holistic approach to what it calls creator economy: users in the ecosystem can mint NFTs on marketplaces and access several platforms to monetise their content, interact with fans, collaborate on art projects, share peer-to-peer content and even apply for funding through the Creator Fund, an initiative by Zilliqa investing in innovation in the NFT and metaverse space.

Disclaimer

This article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets.

This article is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this article or opinions contained herein.

Investing carries risks. Make sure to conduct your own research before making any investment.